It is a bit of a slow process to delete all these accounts, but it is best practice to eliminate all the duplicates prior to importing the file. If you select an account that you cannot delete, QuickBooks Online will give you the following warning/error that says something like this: Once you select delete, a box will pop up that asks you if you are sure you want to delete the account. To delete an account, go to the right-hand side of the chart of accounts in the action column, select the account you want to delete, select View register, then click Delete. The five accounts you will not be able to delete are:ĭelete all the other accounts to eliminate duplicate accounts when you import the sample chart of accounts. There are five accounts you will not be able to delete because QuickBooks Online will not allow it because they are default accounts for importing transactions. Next, delete all the unnecessary accounts. If the numbering is not showing, go the right-hand-side of the chart of accounts, click on the small gear button, select Number to show in the columns. On the right-hand menu look for Accounting. The fourth and fifth digits distinguish sub-accounts.īefore we begin importing our sample chart of accounts for a real estate company, we need to clean out the chart of accounts that QuickBooks Online provides.

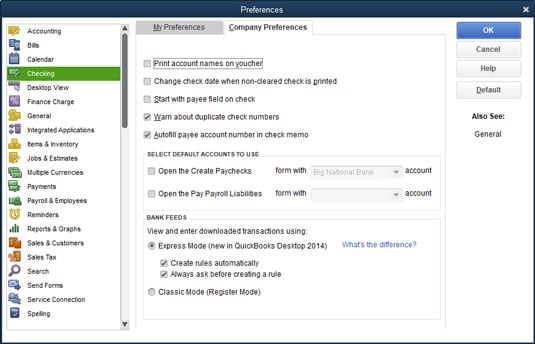

For instance, you might number your retail and office differently. The third digit might be used to distinguish property types. The first two digits are used to identify if the account type: asset, liability, equity, revenue, or expense account. The purpose of establishing account numbers is to help organize how you want your chart of accounts to appear. Next click on Enable account numbers by selecting the pencil on the far right-hand side of the screen.įrom here, click the box that says Enable account numbers and then click Save and exit. Once you are in Account and Settings, select Advanced. Go to the right-hand corner of your QuickBooks Online screen and click the gear icon and then Account and Settings. We will begin by enabling Account Settings. Prior to importing the template file, there are a few steps we need to take to get started. The reports are then able to be shared with both lenders and accountants. The chart of accounts function is to provide structure for both recording and reporting of business transactions. A well-planned chart of accounts and accurately recorded transactions help an owner more clearly steer their business. Setting up a chart of accounts is the first step in setting up an accounting system. Importance of Setting up a Chart of Accounts

QUICKBOOKS ENTERPRISE 2019 EMPLOYEE ADDRESS TEMPLATE HOW TO

We worked with Amy previously on setting up a chart of accounts for a real estate company using QuickBooks desktop and on how to properly set up escrow accounts.

It is because of this that Amy spends so much time early in her relationships with clients to get the chart of account piece right.

As an experienced accountant, Amy has seen her share of poorly organized charts of accounts and the resulting issues this causes for owners. Amy is a local favorite and a go-to person for answering both accounting and QuickBooks questions. We had the opportunity to sit down once again with Amy Heinen from Quick Action Accounting.

0 kommentar(er)

0 kommentar(er)